His vision for starting GWS was to deliver investment strategies and wealth management services typically available at the highest levels of wealth. Today, clients benefit from these sophisticated financial services targeted to meet their unique needs.

Consumers are an integral cog in the American economic engine, but since the financial crisis hit its crescendo, consumers have been under high attack. By most traditional measures, the economy is larger today than any time in our history, but it is hard to argue that consumers are feeling the benefits of that expansion. That said, consumers seem to be taking a new view on debt and spending, all in the name of prudence.

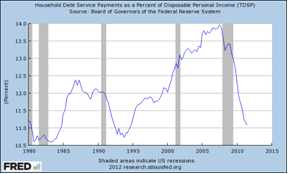

With the benefit of hindsight, virtually everyone can agree that consumers came through the mid-2000s with too much debt, and too little concern about how to pay that debt. Measures such as the household debt service ratio, which measures debt payments on mortgage and consumer debt, reached record highs, nearly hitting 14% in the third quarter of 2007. The good news is that those figures have actually fallen faster than they rose.

Since 2008, the debt service ratio has fallen nearly 3 percentage points and stands at levels last seen in the mid-1990s.

As consumers started to feel mildly better about the economic outlook and about their personal financial situations, they naturally began spending more money.

Throughout 2011, for instance, consumer spending posted a 2.2% gain, after rising a similar 2.0% in 2010. However, those gains are largely coming from a drawdown in savings as opposed to wage growth. After peaking at above 7%, the personal savings rate has steadily declined over the past two years and fell as low as 3.5% in November before a slight rebound in December.

One of the primary reasons consumers have been reticent to spend has been a simple lack of sustained wage growth. In recent months, wages have bounced around in a volatile fashion, falling over the summer, before jumping in the fall and weakening again as winter approached.

Consumers have at least one reason to be optimistic. Labor markets are inching toward definitive improvement for the first time since the recession ended. Initial claims for unemployment benefits have consistently tracked below 400,000 since early November, the longest such period since mid-2008.

Consumers are in better shape than 2007-08, be it from “strategic defaults” or through intentional efforts to act responsibly, but there remains a long way to go to reignite such a vital cog. The good news is that labor markets are gradually thawing, and such improvement should lead to higher wages and better employment prospects.

Related Posts

October 20, 2022

Glassman Wealth Tackles the Midterms

December 4, 2020

COVID Changes Everything About Inflation Expectations

December 3, 2020

The Biden Trade Just Became Irrelevant

Ready to get started?

Connect with a Glassman Wealth advisor today to continue the conversation.