Glassman Wealth is a full-service, fee-only fiduciary providing highly personalized investment advice, financial planning, and wealth management. With one of the lowest client-to-advisor ratios in the industry, Glassman Wealth’s team of engaged, innovative advisors has the time to focus on each client’s unique needs and goals and dreams. This personalized and sophisticated approach enables Glassman Wealth to serve each client as their dedicated financial steward, helping them not simply to achieve their financial goals, but to realize their dreams.

Market prognosticators are full of consternation about the state of the Chinese real estate market, with one publication after another declaring that an asset bubble is only moments away from popping. Clearly the recovery in the Chinese real estate market is impressive, perhaps curiously so, but the dynamics of the Chinese market indicate that an asset bubble is nowhere to be found…for now.

In late 2008, to combat the global economic recession, China enacted a $585bln stimulus program. The announced package represented almost 15% of 2008 GDP and was designed to provide support to housing and infrastructure development in the country. Fast forward 18 months and the program is an obvious success.

The concern is that the program is actually becoming too successful as urban property prices are up nearly 13% from the same time last year, the fastest pace on record. This leaves officials with the unenviable task of slowing a burgeoning housing market without slowing it too far.

When considering whether China is in the early stages of inflating a bubble, it is imperative to consider the underlying dynamics and stark differences from the housing market in the US. Whereas prospective homeowners in the US can buy a house with a 3.5% down payment, China requires minimum down payments between 20% and 30%. Even with that regulation in place, more than 50% of all buyers put 30-40% cash down, according to CLSA. In the US, loan-to-value ratios hover around 75%. Similar measures in China are only 46%.

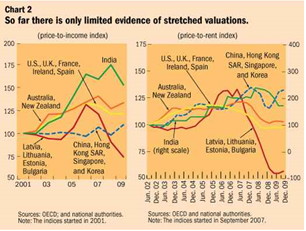

From an affordability standpoint, the price-to-income index is on the rise, but well below the levels seen in the US, UK and even India.

Price-to-rent tells a slightly different story as more individuals are electing to buy in advance of higher expected prices.

Price-to-rent tells a slightly different story as more individuals are electing to buy in advance of higher expected prices.

One could argue that there is a growing degree of frothiness in the Chinese housing market, and in recognition, Chinese officials enacted a series of measures earlier this year to cool the precipitous rise in prices. This includes tighter lending restrictions, higher down payments, increased mortgage rates, greater reserve ratios for Chinese banks and the reformation of property taxes.

China is obviously toeing a delicate balance, attempting to cool housing prices, without derailing economic growth. If Chinese officials were to let prices appreciate at the current rate in perpetuity, a bubble would be inevitable. Recent actions to stem speculative investment indicate that the government is serious about cooling the market.

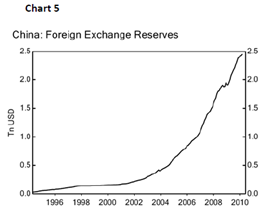

It is also important to remember that China is a country with a disposable war chest of $2.5trln and a demonstrated desire to do whatever it takes to defend against even the slightest hiccup in economic growth.

It is also important to remember that China is a country with a disposable war chest of $2.5trln and a demonstrated desire to do whatever it takes to defend against even the slightest hiccup in economic growth.

Related Posts

October 20, 2022

Glassman Wealth Tackles the Midterms

December 4, 2020

COVID Changes Everything About Inflation Expectations

December 3, 2020

The Biden Trade Just Became Irrelevant

Ready to get started?

Connect with a Glassman Wealth advisor today to continue the conversation.