His vision for starting GWS was to deliver investment strategies and wealth management services typically available at the highest levels of wealth. Today, clients benefit from these sophisticated financial services targeted to meet their unique needs.

Every few months, inflation or deflation resurfaces as the featured topic of discussion. There seems to be an even divide of individuals who believe inflation is a foregone conclusion and those who feel deflation may actually be the bigger concern. Both outcomes are relevant in their own right, but there are growing signs that hidden inflation is creeping into the American economy.

For example, in the month of January, consumer prices rose 0.2%. That came after little or no increase to CPI from October through December. By most accounts, inflation is far tamer than earlier in the post-recession period.

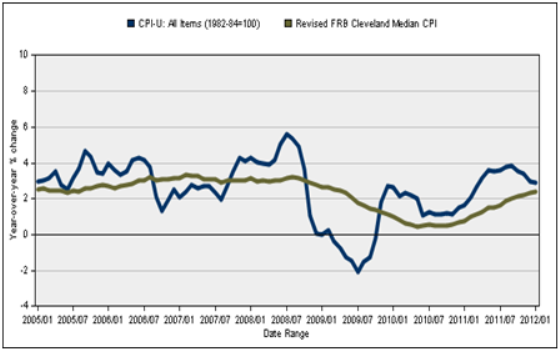

By other accounts, however, inflation is at the start of a pernicious cycle. The Federal Reserve Bank of Cleveland looks at median CPI, which provides a more accurate assessment of underlying inflation trends. Median CPI is approximately 50% more accurate than CPI and 25% more accurate than core CPI.

Based on the Cleveland Fed’s analysis, median CPI rose 0.2% in January, following identical 0.2% gains in each of the previous four months. In fact, median CPI has gradually trended higher for the better part of the past 18 months. Over the past 12 months, median CPI is up 2.4%, the highest reading since early 2009.

Higher Prices and Stagnant Wages

A critical component of the inflation picture remains unsolved: wages. With the unemployment rate still stubbornly high at 8.3%, and every ounce of productivity being squeezed from those who are employed, there is little room to negotiate higher salaries.

At the same time, Americans are likely paying the most attention to what they are spending at the pump. Retail gas prices are at the highest level ever for this time of year. Nationally, prices are at $3.53 per gallon and $4 gas is expected by summertime. According to some economists, a 25-cent per gallon increase costs the economy and consumers some $35 billion.

Gasoline is certainly not the only input into the cost of everyday living, but it is one of the most noticeable and prevalent for consumers. Concerns about the evolving situation in Iran only enhance fears that prices could skyrocket at a moment’s notice.

Banks/High Unemployment Keeping Inflation in Check for Now

Inflation has long been a fear of economists given its “sticky” and stubborn unwillingness to retreat once achieved. Those fears were only heightened once the Federal Reserve began a radical expansion of its balance sheet to prop up banks and other struggling institutions.

Thus far, those measures have aided the firms in need, but largely remained trapped within those echelons and unable to find their way into the broader economy. If, and when, banks and other financial institutions deem it timely to begin lending en masse, we will see a quick shift in inflationary dynamics.

That event is viewed as being far away, but with the economy improving, and inflation returning to many segments of the economy, banks may be the next frontier.

Investors should pay close attention to what the banks do next, as they hold the key to any future inflation. For now, inflation is not ready to fully reveal its presence given high unemployment and only moderate economic growth, but do not be surprised if prices accelerate over the next few quarters.

Related Posts

October 20, 2022

Glassman Wealth Tackles the Midterms

December 4, 2020

COVID Changes Everything About Inflation Expectations

December 3, 2020

The Biden Trade Just Became Irrelevant

Ready to get started?

Connect with a Glassman Wealth advisor today to continue the conversation.