Glassman Wealth is a full-service, fee-only fiduciary providing highly personalized investment advice, financial planning, and wealth management. With one of the lowest client-to-advisor ratios in the industry, Glassman Wealth’s team of engaged, innovative advisors has the time to focus on each client’s unique needs and goals and dreams. This personalized and sophisticated approach enables Glassman Wealth to serve each client as their dedicated financial steward, helping them not simply to achieve their financial goals, but to realize their dreams.

Equity indices logged solid gains this past week with the S&P 500 index up 2.5% and the Dow Jones Industrial Average up 2.6%. The positive outcome was a result of light trading on Thursday and Friday, although it appears there is little conviction in the rally with trading volume falling well short of the 50-day average over the course of both days.

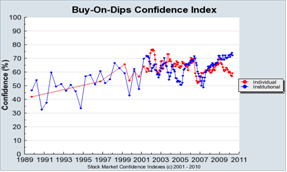

Part of the reasoning behind the lack of confidence may center on individual investors, who are increasingly wary of stock market volatility. A measure of confidence from the Yale School of Management, developed by economist Robert Shiller, shows individual investors are becoming disenfranchised with the market which translates into a lack of willingness to buy equities during periods of correction. Since the beginning of 2009, the individual investor index has been on a distinct downtrend, contrary to institutional investors who are now more willing than ever to buy the dips.

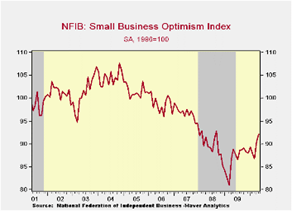

Regardless of the recent market retrenchment, small business owners are tepidly showing signs of confidence, as the National Federation of Small Business (NFIB) Optimism Index rose from 90.6 in April to 92.2 in May. While the index remains at depressed levels, the trend is clearly moving in the proper direction. Firms cite improvements in sales and earnings as the reasons behind the swelling optimism, but, 30% of all small businesses point to poor sales as the most important problem facing their business.

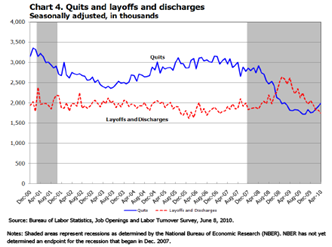

The counterintuitive statistic of the week came courtesy of the Bureau of Labor Statistics in its most recent Job Openings and Labor Turnover (JOLTS) release for April. According to the report, roughly 1.98mln people quit their jobs in the month of April, the highest level in over 12 months. People are only willing to leave positions if they believe greater opportunity exists elsewhere, the opposite of what we experienced during 2009, when more individuals were being forced out of the market through layoffs.

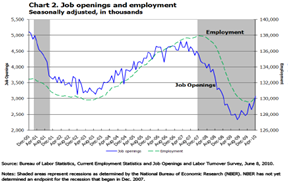

That logic is supported by another statistic in the report which measures the number of job openings as of the end of the month. On April 30th, there were 3.1mln open jobs, up from the cyclical low of 2.3mln open jobs in July of last year. As job openings increase, employment rebounds, ultimately translating into stronger economic growth.

Providing further confirmation of the improved confidence, the Federal Reserve’s most recent Beige Book indicated that “labor market conditions improved slightly with permanent employment levels edging up.” The Fed noted that consumer spending is “improved from the previous report” but consumers are focused on necessities at the moment, not discretionary spending. The news was not all rosy however, as the Fed reported that housing activity was “slowing” in the month of May after the expiration of the home buyer tax credit.

It is likely to be some time before individuals are fully on board with the “recovery” theme, though, as data from the recent Flow of Funds and retail sales reports show. According to the Federal Reserve’s Flow of Funds release for the first quarter, household net worth is still off $11.4trln from its 2007 peak.

Related Posts

Ready to get started?

Connect with a Glassman Wealth advisor today to continue the conversation.