His vision for starting GWS was to deliver investment strategies and wealth management services typically available at the highest levels of wealth. Today, clients benefit from these sophisticated financial services targeted to meet their unique needs.

Fewer than 18 months ago, Meredith Whitney put municipalities on notice for their poor fiscal health. In a scathing 60 Minutes interview, Ms. Whitney declared there would be “hundreds of billions of dollars’ worth of defaults” in municipal markets. While her prediction has thus far proven inaccurate, state and local governments continue to struggle under the weight of a lingering recession and an unfavorable economic environment.

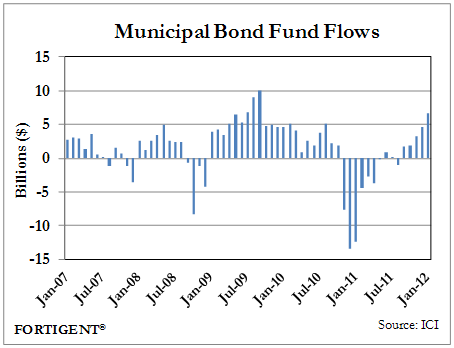

Ms. Whitney’s comments took a quick—and exacting—toll on the municipal markets. Between November 2010 and May 2011, more than $44 billion was yanked from municipal bond mutual funds, based on data from the Investment Company Institute (ICI).

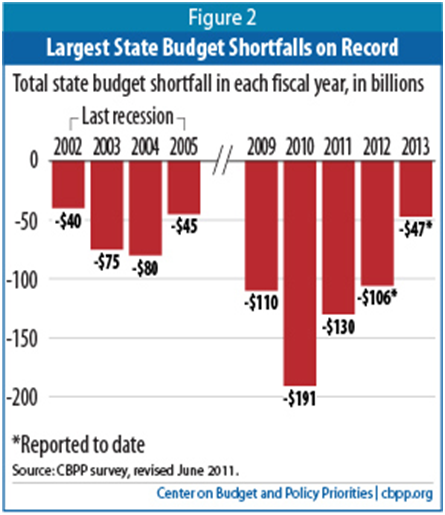

Such concern was warranted…to an extent. According to recent research from the Center on Budget and Policy Priorities, states faced a cumulative budget shortfall of more than $530 billion between 2009 and 2012.

Despite the exceedingly large hurdle, states managed to find their way through via revenue increases, spending cuts, and funding from the American Recovery and Reinvestment Act (ARRA).

First, the Good News…

There is some good news on the horizon. Total state tax collections rose for the seventh consecutive quarter in the July to September period last year, growing 6.1% year-over-year.

Now, the Bad News…

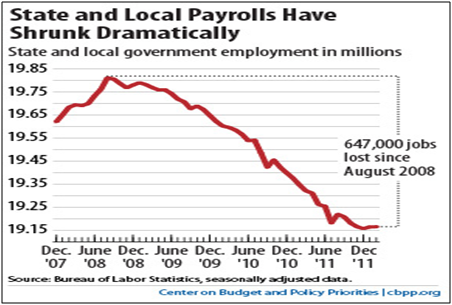

At the same time, there is less optimistic data to report. State and local governments, besieged by the ongoing effects of the financial crisis, continue to lay off employees. In fact, since August 2008, state and local payrolls are off by 647,000. Encouragingly, job losses at the state and local level moderated in the latest month and were essentially flat.

Once investors realized Meredith Whitney’s predictions were not coming to fruition, money once again began to flow into muni bond funds. Between June 2011 and month-end February, more than $25 billion returned to muni funds. Investors were rewarded for their steadfastness throughout 2011. Muni bonds were up anywhere from 7% to 12% in 2011.

The Muni Picture Remains Tentative

While the picture is improving, the coast is not entirely clear. Funds from ARRA are due to diminish substantially in fiscal year 2012 and 2013, falling from $58 billion in FY2011 to $200 million by FY2013. In addition, Meredith Whitney is expected to release a book by the end of 2012, one that will undoubtedly resume the unfortunate attack against municipal finances begun in late 2010.

In the meantime, states will continue to worry about balanced budgets (as mandated by law), and fighting through the headline risk that is unfortunately being thrust upon state treasurers.

Related Posts

October 20, 2022

Glassman Wealth Tackles the Midterms

Ready to get started?

Connect with a Glassman Wealth advisor today to continue the conversation.