His vision for starting GWS was to deliver investment strategies and wealth management services typically available at the highest levels of wealth. Today, clients benefit from these sophisticated financial services targeted to meet their unique needs.

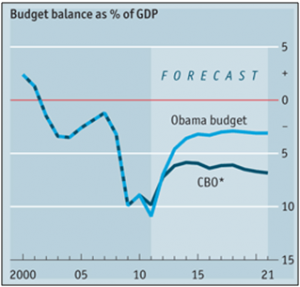

President Obama’s proposed fiscal year 2012 budget was unveiled to a resounding thud. Highlights include a proposed deficit of $1.101trln in fiscal year 2012, or 7.0% of GDP. Long-term, the President expects the budget deficit to fall to 3.1% of GDP by 2021 from 10.9% currently.

By those measures, the outlook is downright rosy, but unfortunately, its assumptions are not realistic.

First, the President estimates average real GDP growth of almost 3.9% between 2012 and 2016, before slowing to 2.6% between 2017 and 2021. The Congressional Budget Office (CBO), a nonpartisan governmental agency, expects real GDP growth of 3.3% and 2.4%, respectively, during those years. This seemingly small statistical change represents a much larger problem in reality. The CBO found that if a mere 0.1% was subtracted from its real economic growth calculations through 2021, the cumulative deficit would increase by $310bln.

Second, the President makes one very bold assumption in his projections, resulting in $338bln in additional revenue over the next decade. This assumption is based on the President’s belief that he can allow Bush-era tax cuts for those making more than $250k per year to expire in 2012. The President was unable to secure such concessions last year when he controlled both sides of Congress and now that Democrats relinquished control of the House, he may face an even more difficult time allowing those cuts to expire.

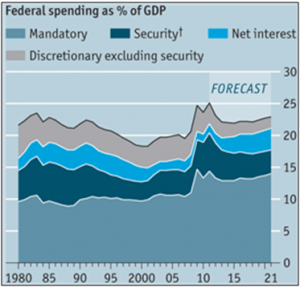

Finally, the President believes it is possible to cut non-security discretionary spending by 11%, from $507 bln in 2011 to $453 bln in 2021, without factoring in the impact of inflation. Excluding the fact that this has never been accomplished previously, cutting such forms of spending in the face of a weak economic recovery would do nothing to bolster growth. As an important aside, non-security discretionary spending only accounts for 12% of all annual outlays. Even if it was possible to entirely eliminate that category of spending, the annual deficit would still be on the order of $600bln.

The most troubling aspect of the Presidential Budget went almost completely unnoticed, not due to its lack of importance, but merely because it is becoming accepted as an inevitability. Tucked deep into the 200+ page budget proposal is one line identified as Net Interest.

The most troubling aspect of the Presidential Budget went almost completely unnoticed, not due to its lack of importance, but merely because it is becoming accepted as an inevitability. Tucked deep into the 200+ page budget proposal is one line identified as Net Interest.

Net interest equals interest payments on the national debt, a figure that will account for annual spending of a staggering $627 bln by 2017 and $844 bln by 2021, more than the cost of Medicare or Medicaid, respectively.

Again, the President makes an assumption that financing costs will be relatively well behaved throughout the next decade. The President believes the 10-year Treasury will remain at 5.3% from 2017 on. The 10-year Treasury has been in a period of secular decline since the early 80’s and as we are all reminded countless times, past performance is no guarantee of future results.

Again, the President makes an assumption that financing costs will be relatively well behaved throughout the next decade. The President believes the 10-year Treasury will remain at 5.3% from 2017 on. The 10-year Treasury has been in a period of secular decline since the early 80’s and as we are all reminded countless times, past performance is no guarantee of future results.

Moody’s, the national ratings agency, was quick to issue a report stating that there is “almost no chance” that the President’s budget would pass in Congress. In addition, Moody’s offered up the possibility that a negative ratings watch would be placed on the US if long-term structural concerns were not addressed.

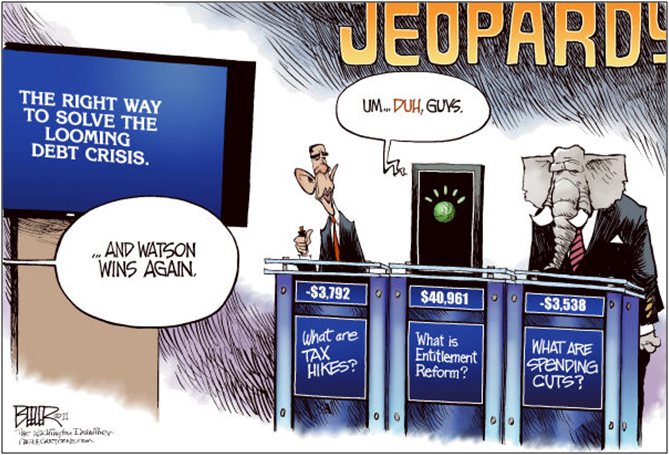

This will not be the fiscal budget that brought the house down, but the hour of reckoning is approaching at an increasingly faster pace. Politicians care more about the longevity of their careers than about truly reforming the system. Eliminating funding for discretionary spending programs will provide a modest amount of cost savings on paper, but will do absolutely nothing to improve our fiscal situation over the long term.

The Lighter Side

Related Posts

Ready to get started?

Connect with a Glassman Wealth advisor today to continue the conversation.