His vision for starting GWS was to deliver investment strategies and wealth management services typically available at the highest levels of wealth. Today, clients benefit from these sophisticated financial services targeted to meet their unique needs.

2012 is going to be a busy year. Not only because of the presidential election but also because by the end of the year it’s likely that many Americans will face higher tax bills.

Why the higher taxes? Well, part of it is due to the expiring Bush tax cuts and the other part to a new Medicare tax on investment or unearned income for families with incomes above $250,000.

Whether Obama wins or loses the election, most believe that at a minimum, he will let the Bush tax cuts expire for those families earning more than $250,000, and perhaps for those below that threshold as well.

With this in mind, we have outlined the projected tax increases, and suggested ways to lessen the impact of these impending higher taxes on your income.

Since the year is still young and we expect there to be a lot of political maneuvering in the upcoming months, we plan to revisit this issue throughout the year, and provide updates to our strategies as circumstances change.

Projected Tax Increases on Earned and Investment Income in 2013:

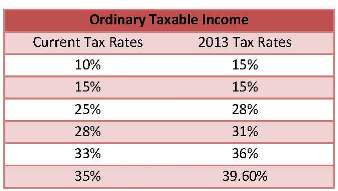

Unless Congress decides to keep the Bush tax cuts for families whose income is below $250,000, rates will increase for all tax payers.

Unless Congress decides to keep the Bush tax cuts for families whose income is below $250,000, rates will increase for all tax payers.

For those who earn more than $250,000, your Medicare tax rate will also increase from 1.45% to 2.35%. For every $100,000 of income you will pay $900 more in Medicare tax.

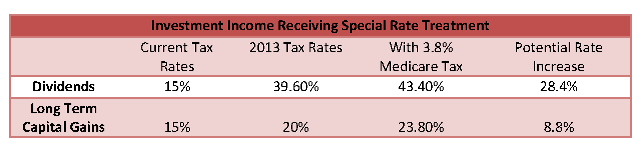

The biggest increase will be felt for those who depend on investment income. Up to now, unearned or investment income has not had to pay the Medicare tax that is imposed on earned income. That changes in 2013. Not only will tax rates substantially increase on dividends and capital gains, an additional 3.8% Medicare tax will be added to families making more than $250,000 a year.

Fortunately, a significant exemption applies to distributions from qualified plans, 401(k) plans, tax-sheltered annuities, individual retirement accounts (IRAs), and eligible 457 plans.

8 Strategies to Reduce Your Tax Bill:

With these tax increases in mind, here are eight ways to potentially reduce your future tax bill:

- Sell appreciated assets to realize gains this year at the 15% rate

- Exercise your non-qualified stock options and pay the ordinary tax at today’s lower rate

- Shift wages and investments to retirement plans such as 401(k) plans, 403(b) annuities and IRAs, or to Roth accounts. Increasing contributions will reduce income and may help you to stay below applicable thresholds. Small business owners may want to set up retirement plans, especially 401(k) plans, and should consider increasing their contributions to existing plans.

- Delay charitable donations until 2013. The value of those deductions will be greater as the tax rate increases. Ex. For those who itemize deductions, the tax savings on a $10,000 donation is $460 more when calculated at 39.6% rather than at the 35% rate.

- Delay to 2013 rather than prepay 4th quarter estimated state income tax payments. This could be particularly attractive if congress eliminates the alternative minimum tax in 2013.

- Run the numbers again on taxable vs. tax-free investments to see if the equivalent yield on your taxable investments (taxable yield less the taxes you paid on it) is greater than the tax-free yield. Higher tax rates may make tax-free investments more attractive.

- Business owners and LLC corporations should consider billing earlier if possible to realize more income before year end rather than in January, 2013

- Consider a Roth conversion this year if you anticipate that your future tax rate will increase next year and in retirement

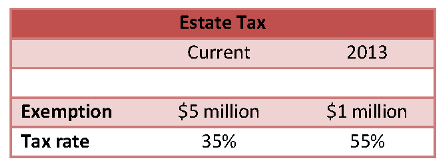

Estate and Gift Tax May Increase Too

Most estate planning attorneys and policy-makers believe that the estate tax exemption, currently at $5 million has nowhere to go but down. If nothing is done by year end, the exemption will revert to $1 million – levels last seen in 2001/02, and the estate tax rate on anything above that amount will rise to 55% from 35%. In addition, for 2011 and 2012, the lifetime gift tax exclusion follows the $5 million estate exemption. Up to this time the lifetime gift exclusion was decoupled from the higher estate exclusions. Many see this as a passing opportunity that may not come this way again.

Most estate planning attorneys and policy-makers believe that the estate tax exemption, currently at $5 million has nowhere to go but down. If nothing is done by year end, the exemption will revert to $1 million – levels last seen in 2001/02, and the estate tax rate on anything above that amount will rise to 55% from 35%. In addition, for 2011 and 2012, the lifetime gift tax exclusion follows the $5 million estate exemption. Up to this time the lifetime gift exclusion was decoupled from the higher estate exclusions. Many see this as a passing opportunity that may not come this way again.

Then there is the issue of portability. Let’s say that one spouse dies and has used only $2 million of their $5 million exemption. Portability allows the surviving spouse an $8 million exemption – their $5 million and their spouse’s remaining $3 million. Without any new legislation in 2013, the portability provision is slated to disappear. This causes many to question traditional gift splitting techniques.

“We have already put on the brakes for gift splitting on clients who have not exceeded the current $5,000,000 per person lifetime limits,” said Chris Sintetos, a partner at Argy, Wiltse and Robinson, a tax and business consultancy firm in McLean, VA.

For example, let’s say that a couple has not used any of their lifetime gift exclusions and plans to make a $2 million gift this year. If each spouse gifts $1 million this year, they risk using all of their lifetime gift exclusions should the law revert back to $1 million next year. If their entire $2 million gift is given by one spouse, they would have no tax to pay in 2011-2012, while the second spouse still has their $1million in tact in the event portability does not survive.

All of the unknowns will require each of you to examine your own crystal ball as many tax professionals are questioning their own beliefs regarding the direction of tax changes. Because of this, where there are income recognition elections, many are extending their clients’ tax returns for both 2011 and 2012 to get the benefit of more election- year hindsight.

Regardless of political affiliation, everyone agrees the deficit must be reduced. Most likely this will require both an increase in revenue (taxes) as well as spending cuts. Once this compromise is reached, the debates will begin on who can afford the increase in tax. My guess is if you are reading this article your taxes won’t be going down. It is just a question of how they will be determined.

Related Posts

Ready to get started?

Connect with a Glassman Wealth advisor today to continue the conversation.