Glassman Wealth is a full-service, fee-only fiduciary providing highly personalized investment advice, financial planning, and wealth management. With one of the lowest client-to-advisor ratios in the industry, Glassman Wealth’s team of engaged, innovative advisors has the time to focus on each client’s unique needs and goals and dreams. This personalized and sophisticated approach enables Glassman Wealth to serve each client as their dedicated financial steward, helping them not simply to achieve their financial goals, but to realize their dreams.

An interesting development has come to the forefront in the past several weeks. Democrats who were previously in favor of allowing the Bush-era tax cuts to expire at the end of this year are suddenly swimming in the opposite direction, with several favoring extensions to the tax credit given the poor economic backdrop. It is easy to find supportive arguments for both camps, but the simple reality is that economically restrictive policies will create a drag on growth at a time when the economy can ill afford them.

The preceding graph details what taxpayers can expect in the upcoming year, barring any extension of the Bush-era tax cuts. President Obama has already detailed a willingness to extend the relief for those making below $250k.

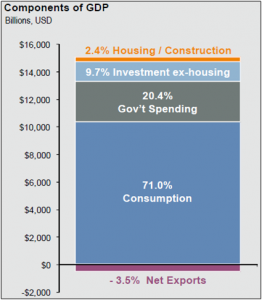

While individuals making more than $137k only represent a small portion of taxpayers in this country, they account for roughly 30% of all consumer spending. Considering our excessive use of debt in every imaginable form, it should come as no surprise then that consumption accounts for 71% of GDP.

While individuals making more than $137k only represent a small portion of taxpayers in this country, they account for roughly 30% of all consumer spending. Considering our excessive use of debt in every imaginable form, it should come as no surprise then that consumption accounts for 71% of GDP.

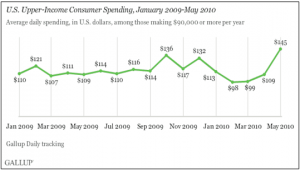

The combination of higher taxes and a weak economy is translating into lackluster spending figures for those higher income individuals. Even accounting for a 33% surge in daily spending during the month of May, spending among individuals making more than $90k a year is still almost  30% below its May 2008 peak. The increase in May was likely a result of “thrift fatigue,” whereby consumers finally reach a point at which they no longer feel like saving. This proves to be a very temporary phenomenon.

30% below its May 2008 peak. The increase in May was likely a result of “thrift fatigue,” whereby consumers finally reach a point at which they no longer feel like saving. This proves to be a very temporary phenomenon.

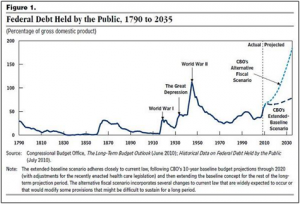

The administration argues that allowing the tax cuts to expire would generate $800 billion of additional revenue over the next 10 years. This is a tidy sum at a time when the federal debt is skyrocketing, but if we learned anything in recent decades, it is that a government with access to more money will spend rather than save the incremental dollars of savings. Until the government learns how to cut back and spend more efficiently, a seemingly impossible task, the new revenue will go the waste.

What these numbers also fail to account for is what happens if the upper income brackets decide to become permanently more frugal and a double-dip recession ensues? The additional dollars of revenue generation would no long matter if we are pushed into 20 years of deflation, similar to what Japan has endured.

What these numbers also fail to account for is what happens if the upper income brackets decide to become permanently more frugal and a double-dip recession ensues? The additional dollars of revenue generation would no long matter if we are pushed into 20 years of deflation, similar to what Japan has endured.

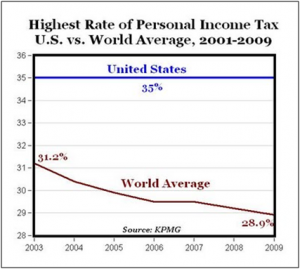

It should also be pointed out that the US is already home to one of the top marginal tax rates in the entire world. Even the oft-ridiculed Europeans are nipping on the heels of the US, after rates in the European Union fell from an average of 41% in 2003 to 36% by 2009.

Democrats understand not only the need to aid the economy, but also realize the difficult battle they face in the upcoming mid-term elections in November. According to the website RealClearPolitics.com, Senate Democrats are dangerously close to losing their majority and right now, Democrats are expected to retain 49 seats, with 43 going to the Republicans. That leaves exactly 8 seats to determine who controls the Senate.

Democrats understand not only the need to aid the economy, but also realize the difficult battle they face in the upcoming mid-term elections in November. According to the website RealClearPolitics.com, Senate Democrats are dangerously close to losing their majority and right now, Democrats are expected to retain 49 seats, with 43 going to the Republicans. That leaves exactly 8 seats to determine who controls the Senate.

The situation in the House is even more tenuous, with 202 seats in favor of the Democrats, 201 to the Republicans and 32 viewed as tossups.

This is not simply a case of higher taxes or the viability of the Democratic majority. Uncertainty around whether or not the tax break will be extended or allowed to expire simply adds to the layers of investor unease.

According to Barclays, assuming the tax cuts roll off at the end of the year, Price/Earnings multiples could contract by one point, from 12x consensus earnings to 11x. Only one point you argue, but with consensus earnings at $96 for 2011, that represents a roughly 100 point differential in the S&P 500.

Democrats understand not only the need to aid the economy, but also realize the difficult battle they face in the upcoming mid-term elections in November. According to the website RealClearPolitics.com, Senate Democrats are dangerously close to losing their majority and right now, Democrats are expected to retain 49 seats, with 43 going to the Republicans. That leaves exactly 8 seats to determine who controls the Senate.

The situation in the House is even more tenuous, with 202 seats in favor of the Democrats, 201 to the Republicans and 32 viewed as tossups.

This is not simply a case of higher taxes or the viability of the Democratic majority. Uncertainty around whether or not the tax break will be extended or allowed to expire simply adds to the layers of investor unease.

According to Barclays, assuming the tax cuts roll off at the end of the year, Price/Earnings multiples could contract by one point, from 12x consensus earnings to 11x. Only one point you argue, but with consensus earnings at $96 for 2011, that represents a roughly 100 point differential in the S&P 500.

With consumers at the upper end of the tax bracket finding themselves dis-incentivized to spend money and the economy in a dangerously perilous position, now is not the appropriate time to rollback prior tax cuts. The 2.4% growth rate in GDP during the second quarter only served to confirm that the economy is gasping for breath and additional restrictive policies will only compound the situation.

Related Posts

Ready to get started?

Connect with a Glassman Wealth advisor today to continue the conversation.