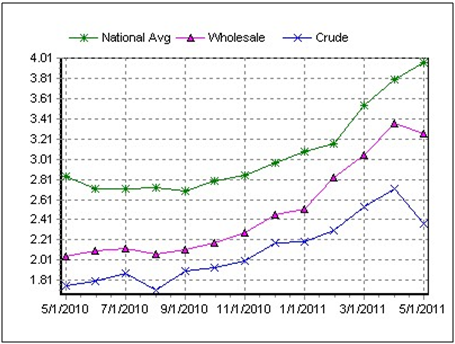

Despite the selloff in crude oil futures, retail gas prices continue to head higher. Behind the ongoing rise is a multi-faceted problem that is unlikely to resolve itself in the near-term.

On May 16th, AAA reported that the national average for a regular gallon of gasoline was $3.96.

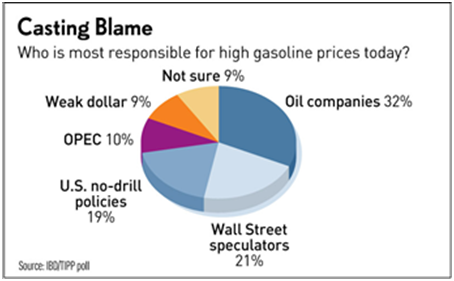

Consumers are directly blaming oil companies and Wall Street speculators for soaring gas prices. A recent Investor’s Business Daily Survey showed that 32% of respondents thought oil companies were responsible for high gas prices, and another 21% thought it was due to Wall Street speculators.

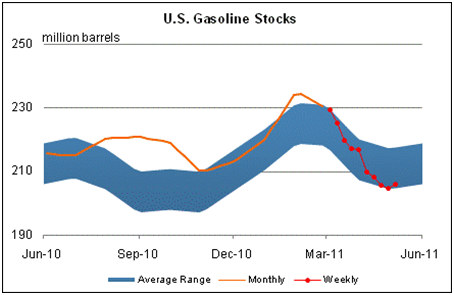

Supporting that notion, consumers should not be surprised to learn that crude oil stocks are above average for this time of year, suggesting that prices are well above where they should be. The trouble arises when we look at gasoline stocks. Generally, at this time of the year, gasoline stocks are between 210 and 220 million barrels.

This year, because of growing demand, gas stocks are at the bottom end of the long-term average range.

For as much as consumers want to grumble about domestic gas prices, they have little room for complaint. Relative to other developed nations, the US enjoys some of the lowest prices in the world. In fact, the price per liter for gas in the US is less than half that of some developed nations.

Favorable tax policies have largely insulated the US from the same exorbitant gas prices seen around the globe. Gas prices are likely to fall in the weeks ahead because of the selloff in crude oil futures, but consumers should recognize that the era of cheap gas is fading.