Equity markets meandered through a comparatively benign week before May’s employment report derailed trading on Friday. The S&P 500 Index finished down 2.3% and the Dow Jones Industrial Average was off 2.0%.

Traders were in a fairly pensive state in advance of the employment report and even without reading any analysis of the release, Friday’s market action made it very apparent how market participants viewed the news.

The economy added 431k jobs in May, with 411k attributable to Census hiring. Reflective of the weakness at the municipal level, state and local government trimmed employment by 13k.

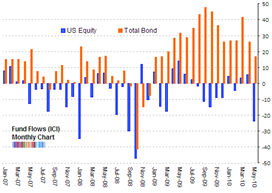

From a contrarian perspective, equity mutual fund outflows hit the highest point since October 2008 during the month of May. Mutual fund investors continue to swap out of equity funds and into fixed income funds.

From a contrarian perspective, equity mutual fund outflows hit the highest point since October 2008 during the month of May. Mutual fund investors continue to swap out of equity funds and into fixed income funds.

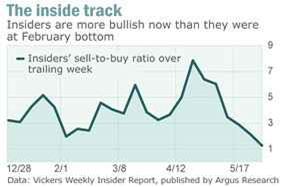

As retail investors are bailing on the equity markets, corporate insiders are becoming more confident in their own companies. Insiders are selling 1.26 shares of corporate stock for each share bought, far below the long-term average and the 7.82 to 1 sell to buy ratio in early April.

Although there remain pockets of positive news, investors are still wary of the unknowns. Chief among those unknowns is the ability of the US government to continue financing its debt. Total US public debt outstanding crossed the frightening $13trln mark on June 1st. The gap between US GDP and public debt is growing ever narrower and projections from the International Monetary Fund indicate that public debt will jump above GDP by 2012.

Although there remain pockets of positive news, investors are still wary of the unknowns. Chief among those unknowns is the ability of the US government to continue financing its debt. Total US public debt outstanding crossed the frightening $13trln mark on June 1st. The gap between US GDP and public debt is growing ever narrower and projections from the International Monetary Fund indicate that public debt will jump above GDP by 2012.