For almost a decade, there has been a factor that has helped boost the returns for many investors. During the past 20 years, investors have steadily increased their exposure to this factor, so that on average, more than 20% of the equity portion of all retirement accounts could be affected. Recently, though, this trend has reversed course leaving many more investors vulnerable to its impact. So what is this critical factor? Currency.

For U.S. investors who own foreign stocks or stock funds, they are, in effect placing two bets – one on the stock itself and one on currency.

We all understand stocks – if we own them and they go up in value, we benefit. But currency makes this a bit trickier. You see, there is a boost in returns when the dollar falls against a foreign currency. As we, in the U.S., own foreign stocks in foreign currency, we can see gains even if the stock price doesn’t move. Let me explain.

Let’s say we buy Toyota Motor Corp., which is based in Japan. And over a period of time Toyota’s stock does not change in price at all. But during this same period, the yen jumps 10% against the dollar. If we sell the stock, we experience a 10% gain, not because the stock’s value increased, but because of the change in the value of the currency.

How much of an impact does currency have on the total return in your foreign stock portfolio? Well, the numbers are nothing short of astounding.

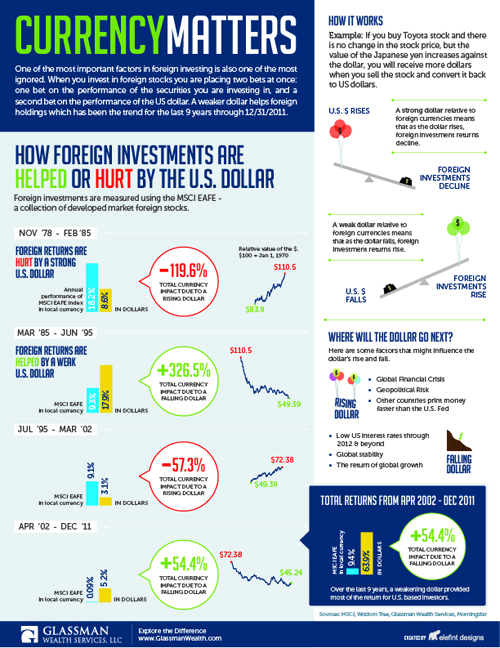

We created an infographic to show how currency has helped or hurt returns over the last 35 years. We looked at the MSCI EAFE – an index which stands for the Morgan Stanley Capital International Europe, Australasia, and Far East that represents mostly developed rather than emerging markets. In our infographic, the returns of the MSCI EAFE Index show that a falling dollar serves as a tailwind pushing greater returns on foreign stocks, while a rising dollar functions more as a headwind, cutting back on EAFE returns.

Over a 9.5 year period ending this past December, the overall MSCI EAFE Index gained 63.9% in total return. Of that only 9.4% were gains in foreign stocks. The remainder, a solid 54.4%, was the impact of the falling dollar!

The fact that the tailwinds of a falling dollar have suddenly turned into headwinds in 2012 is finally making news.

If the dollar continues to rise against a basket of other developed market currencies, those investors who own foreign stocks could see disappointing performance; not necessarily because the companies or the stocks don’t perform well, but because of an ongoing headwind, or rising value of the dollar in this asset category. With that in mind here are five important things investors need to know when investing in foreign stocks:

- When investors purchase a foreign stock or stock fund, they are actually placing two bets: one on the stock itself and the other on the currency the stock trades in. When the dollar falls there is a benefit to us here in the U.S., and when the dollar rises there is a detriment.

- History tells us that the value of the dollar relative to developed markets is a cyclical pattern. While the falling dollar has helped investments in foreign stocks over the last decade or so, there have been periods in the past where a rising dollar caused huge headwinds, and certainly losses in many cases, for foreign stocks. During the period of July 1995 through March 2002, currency reduced performance by a significant 57.3%.

- While many investors have benefitted by owning foreign stocks over the past decade or so, it has really been their investment in currency that has performed so well. Currency was responsible for most of the gains in developed market returns since April 2002.

- Investors in general have a much greater percentage of equity exposure invested in foreign securities than 10 or 20 years ago. According to the Investment Company Institute, global equity has increased from 3.7% of total equity in retirement accounts in 1992 to 23% at year-end 2011.

- While the currency portion of the two bets has worked extraordinarily well for U.S. investors since 2002, it may be time to reduce exposure or take that bet off the table altogether. Fortunately, there are ways investors are able to accomplish this.

In my next article, I’ll provide further details about some of the options investors should consider that still use foreign stocks to diversify investment portfolios, but that also reduce or, in some cases, eliminate the currency bet.