If congress ever comes to a consensus on debt reduction, or even a revamp of the tax code, there are some deductions that are likely to disappear; and right after the deduction for private jets, is the mortgage deduction for second homes.

Congress left the deduction of mortgage interest unscathed back in 1986 when they eliminated deductibility of most other personal loans. Now that both sides of the aisle are looking to increase revenue, many politicians want to retain the mortgage deduction, but believe that Congress never intended for the deduction to be used to promote second home ownership.

As we consider the ramifications of the loss of this deduction, we must consider where, how and how much?

Where:

In the infographic below, we used 2010 Census data to show the states with the highest percentage of second home ownership, the greatest number of second homes, and the percentage change since the 2000 census. While we found it interesting that Maine had the highest percentage of second homes, Florida has by far the largest number of second homes, and Nevada has had the greatest percentage increase, it will be the pockets of communities within these states where most of the homes that are non-primary residences will feel the greatest impact.

Embed Second Homes in the United States on Your Site: Copy and Paste the Code Below

Vacation resorts that are not necessarily retirement destinations should feel the most price pressure. A community such as Ocean City, Maryland, while a fine place to visit in the summer, is not teeming with seniors or retirees. In these communities, we could find a spike in vacation rentals as owners look to replace mortgage deducibility with rental income and other offsets like depreciation and expenses.

However, other communities like Park City, UT or Hilton Head, SC may fare better if those who own a second home intend to retire there someday. These transitionary second homes will eventually become their primary residences when these owners finally retire.

California, with only 2.2% of second homes, may fare better, but in those towns and counties where a significant number of properties are used as second homes, the loss of the mortgage deduction could lead to an increase in short sales as owners struggle to make two mortgage payments. It may not be a stretch that many of the second homes in Nevada, where the number has doubled in the last ten years, have owners who are already underwater on their mortgage and unable to refinance even at today’s historic low rates. The additional tax cost will further dampen any recovery here.

How and how much:

As we wait for a rebound in home prices, any additional costs, like the loss of the second home deduction may be enough to keep would-be buyers away. Certainly, historically low mortgage rates help sales; and any sort of help from the government (QE3 or Operation Twist) that further lowers intermediate and long-term rates is good news for the housing market as mortgage rates continue to move to new lows. While the loss of the deduction may not have an immediate effect, the impact will be found in the smaller line of people willing and able to buy the home.

As one looks to qualify for the mortgage on a second property, lenders will need to incorporate the new higher non-deductible cost and disqualify those who exceed acceptable standards.

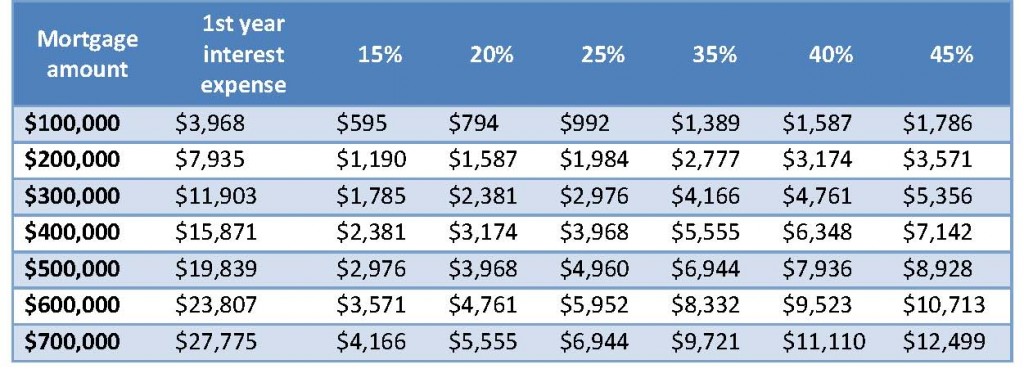

Then there is the actual increase in cost. Based on a 4% 30-year mortgage, homeowners will find the following cost increases based on the size of their mortgage and their tax bracket:

These additional costs may not sway most to give up on their dream of owning a place in the mountains or at the shore. But a time when we remain skeptical of a housing rebound, and with many primary residences underwater on their mortgages and lenders holding their funds ever so tightly, these additional costs add up to greater pressure on second home prices over the coming years.

My hope is that our infographic starts a conversation about second home ownership in each state, and particularly the communities in each with a larger number of second homes. Since 49 states have counties where second homes account for at least 10% of all homes, these communities, some already under the strain of foreclosures and weak sales are certain to feel the loss.