[sc name=”Are Stocks expensive?” ] It’s a question that many of our clients have asked us as the stock market continues to hit new highs seemingly every day. And one […]

Read MoreThis is one post in a series based on our “Tough Questions for Your Advisor.” Each post covers one of the important topics we discuss with our wealth management clients. Today’s topic is: Are […]

Read MoreWith Donald Trump re-elected as the 47th President of the United States, investors are closely examining how his policies could impact the economy and their portfolios. Early responses in global […]

Read MoreIt’s now possible to invest for basically nothing. On one side of the cost spectrum are firms like Vanguard and Betterment, who are commoditizing low-cost investing. On the other side […]

Read MoreThis article was originally published on Forbes on June 5th, 2018. When it comes to their portfolio, investors might just be their own worst enemy. Of course they’re not intentionally […]

Read MoreThis article was originally published on Forbes on March 13, 2018. High yield bonds, also known as “junk” bonds, have always had an identity crisis. They show up in our […]

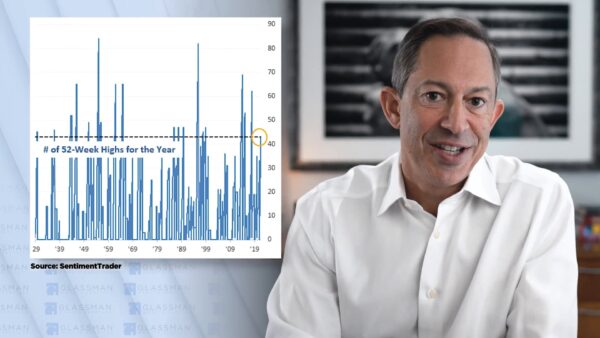

Read MoreAs the stock market continues to reach new highs, I’m hearing more discussions and debates from investors to analysts about when it’s expected to top out. In fact, many clients […]

Read More